Financing Architecture

- ROBERTO SALAZAR CORDOVA

- Nov 25

- 5 min read

How Sierra|ANDES Structures Risk and Value:

Fund, DBOT and EPC

under the ER-RSC Framework

By Roberto F. Salazar-Córdova

Chino Salazar de Quito

Sierra|ANDES is, at its core, a long-term infrastructure and nature-based investment strategy in the Andes.

It builds value, starting with high-impact carbon and water projects in Ecuador and scaling across the region.

For interested investors, one question matters above all:

How is risk actually managed by us, from idea to execution?

The answer is architectural.

In Sierra|ANDES, every project is built around three clearly separated roles:

the Fund, which manages capital;

the DBOT unit, which designs and accompanies projects end-to-end;

the EPC, which builds and commissions the assets.

All of this operates under a proprietary risk framework: ER-RSC, aligned with the PACES lens (Politics, Environment, Culture, Economy and Society).

Below is how this architecture works for you as an investor.

1. Three roles, three responsibilities

1.1 The Fund: capital and fiduciary responsibility

The Fund (managed under the Red Santa Cruz platform) is a regulated investment vehicle. Its job is straightforward and non-negotiable:

define the investment thesis (sector, geography, ticket size, horizon);

select and approve projects;

allocate capital across the project cycle;

monitor risk and return;

report clearly to investors.

The Fund does not do consulting. It does not build roads or plants. It makes investment decisions and supervises performance.

1.2 The DBOT unit: design and end-to-end support

The DBOT unit (with CSPINC.TECH as core engine) provides integrated Design–Build–Operate–Transfer services. It is the “technical and strategic brain” of Sierra|ANDES projects.

By phase:

Design

Identify opportunities.

Run technical, financial, legal, environmental and social studies.

Structure contracts and risk matrices.

Build (accompaniment)

Track construction milestones, scope changes and key decisions.

Support governance so that risk is shared as planned.

Operate

Help design the operating model and performance KPIs.

Monitor early operation and impact.

Transfer

Prepare hand-over to public entities, communities or new private operators.

Support contract renewals or closure.

DBOT is not an asset manager. It is a professional service provider to the project and the Fund, with fees linked to well-defined tasks, not to discretionary control over investor capital.

1.3 The EPC: execution and delivery

The EPC (Engineering, Procurement and Construction) partner is responsible for:

detailed engineering;

procurement and logistics;

construction and commissioning.

The EPC is contracted with clear pricing, deadlines, performance indicators, incentives and penalties. In Sierra|ANDES, EPCs are chosen and evaluated not only on cost, but also on their ability to work under our environmental, social and governance standards.

2. Four phases of the project cycle

Sierra|ANDES organizes projects in four main phases. The architecture Fund–DBOT–EPC is designed to be consistent across all of them.

Phase 1 – Identification

DBOT screens and shapes ideas:

What problem are we solving?

Who are the stakeholders?

Is there a viable Andean solution?

The Fund defines eligibility criteria and authorizes moving from “idea” to “pipeline project”.

EPC may provide high-level input on technical feasibility and cost ranges.

Phase 2 – Pre-investment (Design)

Here most of the value and most of the risk are determined.

DBOT leads:

technical and environmental studies;

social and governance design (with indigenous communities, cooperatives, municipalities);

financial modelling and contract architecture.

Fund finances pre-investment selectively, when projects fit the thesis and pass an initial ER-RSC screen.

EPC validates constructability and cost ranges, but does not decide whether capital is committed.

Phase 3 – Financing (Detail and closing)

At this point the project is bankable—or it should not move forward.

Fund decides:

how much capital to commit;

in which form (equity, debt, hybrids);

under what return expectations and time horizon.

DBOT adjusts the financial model and contracts to meet fund and co-lender requirements.

EPC signs its EPC agreement with a clear risk allocation and delivery plan.

Phase 4 – Execution

EPC builds and commissions the asset.

DBOT accompanies:

monitors milestones;

supports claim management and renegotiations within the contractual framework;

updates risk matrices as reality unfolds.

Fund supervises through an Investment Committee and an Accompaniment Committee, both supported by ER-RSC reporting.

If deviations emerge, they are flagged and treated early—before they become systemic.

3. The ER-RSC framework: how we read risk

ER-RSC (Risk Evaluation – Red Santa Cruz) is the internal framework that aligns every decision in Sierra|ANDES with the PACES lens:

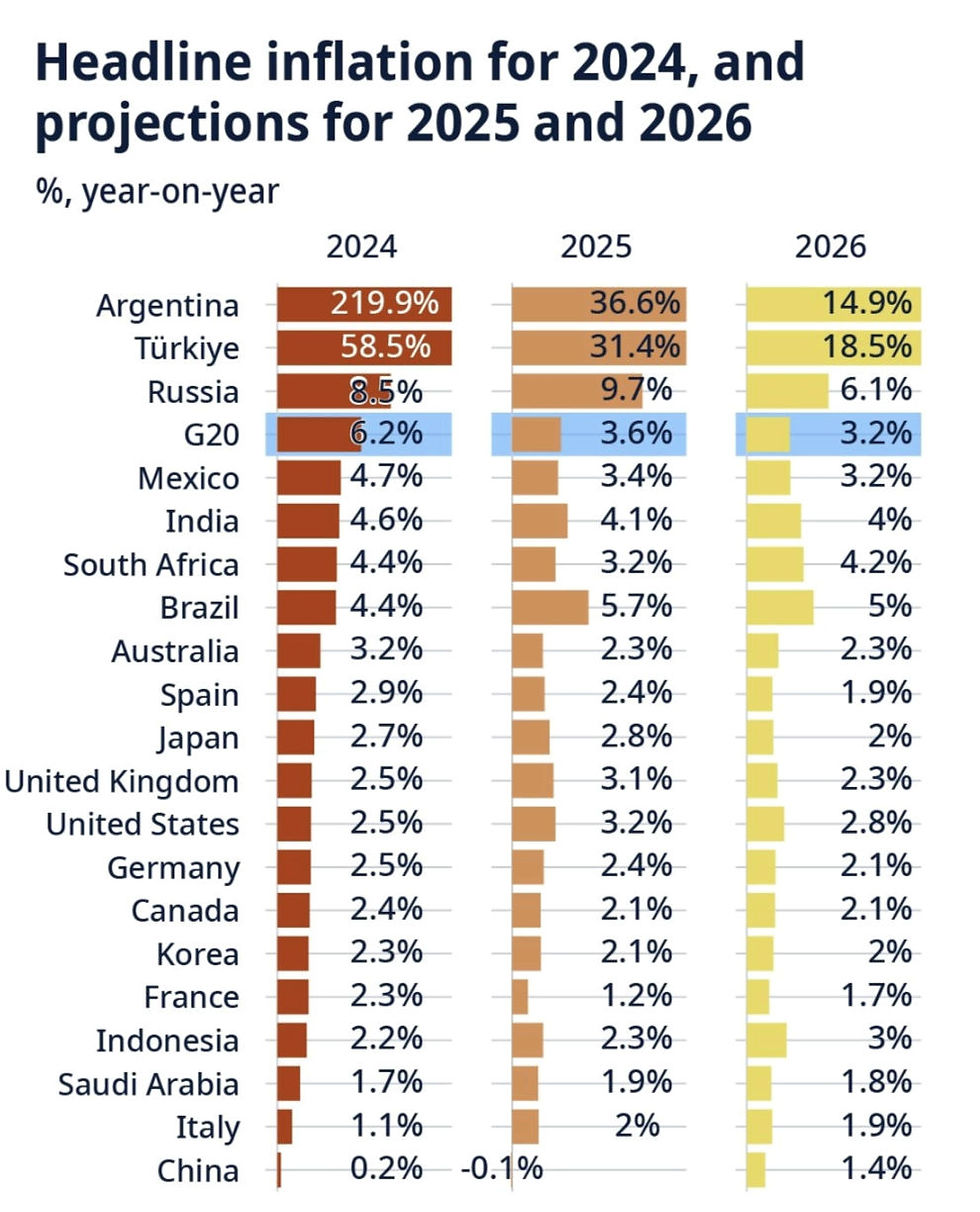

Politics: Is there sufficient legal clarity, governance and institutional stability?

Environment: Does the project meet strict environmental and climate standards?

Culture: Is the project consistent with local identity and community expectations?

Economy: Do the numbers make sense in terms of returns, liquidity and macro context?

Society: Is the impact meaningful and fair for the people on the ground?

ER-RSC is applied to:

each project at every phase;

the DBOT unit as a service provider;

each EPC as a contractor.

For investors, this means that the Fund is committed not to allocate capital to projects that may be profitable on paper but structurally destructive for its own license to operate.

4. Why the Fund does not “do everything”

In many emerging-market deals, the temptation is to concentrate all roles in one entity: the fund invests, designs, structures, “advises”, even behaves like a hidden EPC. It looks efficient; it usually ends badly.

We avoid that for three reasons:

Operational risk

Managing third-party capital is already complex. Adding full design and execution inside the same regulated vehicle multiplies the chance of mistakes.

Reputational and regulatory risk

When the same actor designs the project, approves the investment and pays itself for all services, the line between fair compensation and rent capture becomes very thin. Regulators, co-investors and communities will eventually question it.

Systemic financial risk

If the integrated model fails, everything fails at once: the fund, the advisory function and the execution capacity. There is no room to replace a weak piece without damaging the whole.

By clearly separating the Fund, the DBOT unit and the EPC, Sierra|ANDES preserves flexibility:

the Fund can replace the DBOT provider for future projects if performance is not satisfactory;

it can change EPCs when delivery standards are not met;

and it can demonstrate that investment decisions rely on independent analysis, not on internal cross-selling.

In risk language: we deliberately trade a small part of the margin per project for greater structural resilience and credibility.

5. What this means for Sierra|ANDES investors

For investors looking at Sierra|ANDES as a long-term Andean platform —combining carbon, water, biodiversity and social infrastructure— the Fund–DBOT–EPC architecture under ER-RSC offers:

Clarity: you know who does what, and why.

Governance: investment committees and independent directors can say “no” when risks are misaligned.

Adaptability: under-performing service providers can be replaced without collapsing the platform.

Impact with discipline: communities and territories are part of design and governance, not an afterthought; but projects still meet rigorous financial and technical standards.

In simple terms: Sierra|ANDES is not just a story about the Andes, carbon and indigenous leadership. It is also a story about learning from decades of failed infrastructure in the region and deciding to build differently—with a Fund that manages capital, a DBOT engine that thinks and accompanies, and EPC partners that execute under clear rules.

That is the structure behind the Urku ecosystem and the broader Andean agenda we are putting on the table.

Roberto F. Salazar-Córdova

Chino Salazar de Quito

Official reference: www.adnplus.co.uk

Comments